Starlink has become an attractive investment opportunity for many, partly due to the involvement of CEO Elon Musk, who tends to draw significant attention with any of his ventures. Additionally, Starlink operates under SpaceX, a well-known player in the space industry that has received a lot of media coverage with its impressive launches. SpaceX has also begun decreasing download speeds for users who exceed one terabyte of monthly usage during peak hours, potentially hurting customer loyalty and slowing growth. Starlink Internet aims to provide reliable and low-latency internet connectivity with speeds of up to 1 Gbps. Users need to install a small satellite dish and modem to connect to the network. The service is currently in beta testing, and users can sign up for the service on the Starlink website.

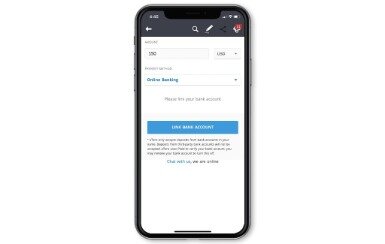

This means that investing in tangential partners of Starlink — or in the industry as a whole — is a great way to invest in Starlink before its IPO. Additionally, the supply and demand dynamics of the market can influence the price of a stock. Using a constellation of satellites that use a low earth orbit path with entire global coverage will reduce latency and provide reliable internet access regardless of location. Equitybee provides accredited investors access to pre-IPO startups by funding employee stock options. In exchange, investors gain a portion of the future stock value. The acronym stands for ‘Initial Public Offering’, it’s a process used by large private companies to raise additional capital.

- A mobile app assists in location selection and verifies that a location is free of obstructions.

- Not only does Musk see this as fundamental to the progression of internet technology, but the company could also prove to be an incredibly profitable endeavor as well.

- Tesla brought self-driving EVs into existence and SpaceX is working toward making Mars inhabitable.

- However, Musk has called those reports false, reiterating his desire for the business to continue maturing before it goes public.

- From communication to work to travel, the internet has become an integral part of life in the modern world.

Musk says the company needs up to $30 billion in annual funding to survive. He said in 2021 that the company was spending $1,000 to produce Starlink terminals, which it sells for $500. Thus, while Starlink has secured some funding, it will need more to survive — and ultimately bring its manufacturing costs down. Having its own rockets has allowed the company to launch about 2,000 satellites since May 2019, or more than 600 per year. Having more satellites in the sky may enable consistently faster speeds and fewer interruptions.

What is an IPO? How do I buy IPO stocks?

As a subsidiary of a private company, Starlink has not made available to the public its financial details. However, the Federal Communications Commission recently awarded SpaceX a nearly $900 million subsidy for Starlink to support rural broadband access, indicating a truly substantive business. A SpaceX subsidiary, Starlink is a satellite-based internet https://bitcoin-mining.biz/fxgiants-scam-broker-complaint-review/ service provider, delivering high-quality, low-latency performance. Most importantly, SpaceX CEO and Tesla Elon Musk promised to push the Starlink IPO when it is financially viable to do so. Looking for ways to invest in Starlink and the space industry? Here are some investment advisors that will be well versed in the satellite internet space.

This can give investors exposure to the company without having to purchase individual shares. SpaceX hasn’t said when it will IPO Starlink, but it did set a precondition — and Starlink may have just attained it. According to recent reports, Starlink has successfully completed a beta test of its internet service, which could be a positive sign for investors. In October 2021, SpaceX was valued at $100 billion after a secondary share sale, with notable investors such as Alphabet Inc. and Fidelity Investments. While estimates vary, some analysts project Starlink’s value to exceed that of SpaceX in the future, with Morgan Stanley’s Adam Jonas forecasting a $50 billion valuation in 2020. It is impossible to predict how much will Starlink stock cost when it goes public, as the stock price will be determined by market demand and various other factors.

- We strive to provide up-to-date information, but make no warranties regarding the accuracy of our information.

- Equitybee gives accredited investors access to hundreds of private, VC-backed startups before they IPO.

- In the modern age, where connectivity is paramount, Starlink emerges as a beacon of hope for a connected world.

- The Starlink Internet service has the potential to revolutionize internet connectivity, especially in areas with poor internet infrastructure.

- As of now, Starlink is not a publicly traded company and therefore there is no way to know how much is Starlink stock.

Starlink was founded in 2015 by Elon Musk’s aerospace company, SpaceX. In recent years, the demand for high-speed internet connectivity has surged, leading to the emergence of new and innovative technologies. One such technology is Starlink, a satellite-based internet service provider owned by SpaceX.

A Comprehensive Guide on How to Invest in VUSXX

Not only does Musk see this as fundamental to the progression of internet technology, but the company could also prove to be an incredibly profitable endeavor as well. In fact, the president and COO of SpaceX, Gwynne Shotwell, has said that she feels the valuation could one day reach $1 trillion. You cannot invest in Starlink directly yet, as it is not a public company.

Outlook for Starlink Stock

Finder.com is an independent comparison platform and

information service that aims to provide you with information to help you make better decisions. We may receive https://currency-trading.org/strategies/best-free-forex-trading-indicators-for-metatrader/ payment from our affiliates for featured placement of their products or services. We may also receive payment if you click on certain links posted on our site.

Skylink plans to launch tens of thousands of satellites into low-Earth orbit, providing low latency and high-speed Internet across the globe. At this rate, it won’t take them very long to reach that goal. Though anticipation is sky-high for Starlink’s debut, you won’t find this name listed on an official IPO calendar. In a series of tweets, Elon Musk repeatedly expressed his interest in spinning off his SpaceX subsidiary as a publicly-traded entity.

Starlink Company Statistics

The views about companies, their securities and funds expressed in this article reflect the personal opinions of the individual writer. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) https://coinbreakingnews.info/cryptocurrency-trading/forex-white-label-solution/ on whether to buy, sell or hold shares of any particular stock. None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners.

The platform is widely known for its social and copy trading features. It allows users to trade stocks, forex, commodities, cryptocurrencies, CFDs, and ETFs. Hence, Starlink could be a boon to rural areas and other places where internet service is sparse.

Step into the future with Starlink’s user terminals, sleek devices that resemble sci-fi artifacts. Explore the technology behind these terminals, which serve as the bridge between users and the vast satellite network above. Learn how they automatically align with satellites, creating a dynamic connection that brings high-speed internet to even the most remote and underserved areas. Starlink, on the other hand, aims to bridge the digital divide by offering high-speed internet access to underserved and remote areas. This approach opens doors to an untapped market, promising a significant user base.

The fact that Starlink delivers internet services using satellites in orbit, instead of traditional cables and towers, also makes it a novelty that excites investors. Starlink’s unique and promising approach has garnered the attention of institutional, retail and other top investors alike. The Starlink Internet service has the potential to revolutionize internet connectivity, especially in areas with poor internet infrastructure. With a growing network of satellites, the service is expected to become widely available in the coming years, offering an alternative to traditional internet service providers. We’ll dive into all the key areas, such as the company statistics, revenue, competitors, and everything you need to know about the Starlink IPO (initial public offering).